Top 10 Commercial Energy Storage Companies in 2025

In this guide, we group ten widely recognized names into three categories—Battery Cell & Pack Leaders, BESS Integrators & Commercial Energy Storage Solution Providers, and Inverters/PCS & ESS Providers—and summarize each brand through the lenses that matter most to buyers: where they’re based, what they build, how their products are used, and what they’re known for in real deployments.

Top 10 Commercial and Industrial Energy Storage Brands in 2025

Brand | Founded | Main Products | Positioning | Typical Applications | Key Advantages |

CATL | 2011 | ESS battery cells, modules/packs, some system solutions | Battery cell & supply-chain leader | C&I storage, utility-scale BESS, renewables integration | Massive manufacturing scale, strong global supply capability, broad project footprint |

BYD | 1995 | LFP batteries, ESS systems/containers | Vertically integrated battery + system provider | C&I, industrial parks/microgrids, utility BESS | Strong vertical integration, wide product coverage from battery to system |

LG Energy Solution | 2020 | ESS cells and battery packs (supply) | Tier battery manufacturer | C&I and utility ESS supply | Mature R&D and production, global customer base and supply network |

Samsung SDI | 1970 | ESS batteries, modules/packs | Established battery manufacturer | C&I ESS supply, system OEM partnerships | Long track record, strong quality and reliability systems |

Tesla Energy | 2015 | BESS products (e.g., Megapack), energy management | BESS system provider / integrator | Utility-scale and large commercial deployments | Highly standardized systems, strong delivery scale, strong brand ecosystem |

Fluence | 2018 | BESS systems, controls & optimization software | System integrator + software platform | Grid services, peak shaving, large-scale BESS | “System + software” strength, market-facing optimization capabilities |

Huawei Digital Power | 2021 | PV + ESS solutions, digital energy platform | Digital power & storage solutions provider | C&I solar + storage, site energy management | Strong digital monitoring/O&M, mature PV-storage integration approach |

Envision Energy | 2007 | BESS systems, energy management platform | Solutions + digital energy management | Industrial parks, C&I, utility BESS | AI/IoT-enabled platform approach, lifecycle energy management focus |

SRNE | 2009 | C&I storage inverters/PCS, related solutions | C&I core equipment & solutions provider | Factories, business parks, commercial buildings | Dual-battery management and high battery-current design support flexible configurations and phased expansion; installation/O&M-friendly features |

Sungrow | 1997 | PCS/inverters, ESS solutions | PCS/inverter + ESS provider | C&I and utility-scale projects | Strong power-electronics heritage, broad product portfolio, large deployment experience |

A.Battery Cell & Pack Leaders

CATL

Founded: 2011

Headquarters: Ningde, Fujian, China

Products & What They Do:

CATL provides the core battery components used in commercial energy storage and large-scale storage projects—lithium-ion cells, modules, and battery packs. These components largely determine how much energy a system can store, how efficiently it can deliver power, and how consistently it performs over thousands of charge/discharge cycles. In day-to-day operation, the purpose is simple: store energy when supply is available (or prices are low) and deliver it when demand rises or electricity becomes more expensive.

Beyond battery hardware, CATL also supports deployment through battery management and safety-oriented design considerations. This helps system providers maintain stable performance across different operating modes—whether the system cycles daily to reduce bills, keeps reserve capacity for backup, or adjusts output to balance renewable generation. As a result, commercial energy storage installations can more reliably achieve outcomes like peak shaving, load shifting, backup power, and smoother integration of solar and wind.

Applications:

Commercial & industrial (C&I) storage, utility-scale storage plants, solar/wind + storage projects, campus microgrids, and grid stability/ancillary services.

Company Advantages:

CATL’s strengths are most visible when projects scale. High production capacity and a mature supply chain can make it easier to secure the volumes needed for large deployments, phased expansions, or multi-site rollouts—reducing scheduling and procurement uncertainty. At the same time, strong manufacturing consistency helps integrators deliver systems that behave more uniformly from one container or site to another, which can simplify commissioning, performance verification, and daily operations.

Over the long term, this combination supports better lifecycle planning. With stable supply and consistent performance, owners can forecast output more confidently, schedule maintenance with clearer expectations, and build more dependable financial models—especially for commercial energy storage assets that cycle frequently or must meet strict availability requirements.

BYD

Founded: 1995

Headquarters: Shenzhen, China

Products & What They Do:

BYD offers both ESS batteries (cells and packs) and complete system solutions for commercial energy storage system. Instead of stopping at components, BYD can deliver a more packaged, deployment-ready setup that’s designed around real business outcomes.

In daily operation, these systems are commonly used to lower energy costs and improve site resilience: shaving demand peaks, shifting usage away from expensive time windows, providing backup for critical loads, and supporting microgrid-style coordination with solar and other onsite sources. The practical benefit for many facilities is straightforward—more control over energy use and less reliance on the grid at the worst times.

Applications:

C&I storage, industrial parks/factory microgrids, solar + storage projects, and selected grid-scale deployments depending on region and project requirements.

Company Advantages:

BYD’s key strength is end-to-end capability—from battery manufacturing through system delivery—which can simplify purchasing and reduce “multi-vendor friction.” That often means clearer responsibility, smoother integration, and fewer compatibility headaches during commissioning. BYD is also known for flexible system configuration, making it easier to replicate a solution across multiple sites while still adapting to each location’s tariff structure, load profile, and operating priorities.

LG Energy Solution

Founded: 2020

Headquarters: Seoul, South Korea

Products & What They Do:

LG Energy Solution primarily supplies ESS cells and battery packs used in commercial energy storage system and utility-scale projects. In many deployments, LGES products sit inside systems built by integrators and OEMs as the battery “engine” that drives performance.

The emphasis is on consistent, repeatable behavior over time—stable cycle life, reliable output, and predictable efficiency across long operating periods. That predictability matters when storage is expected to deliver savings day after day, follow defined operating schedules, or meet performance guarantees.

Applications:

Battery supply for C&I and utility-scale storage projects—most often as an upstream battery partner for integrators and OEM platforms.

Company Advantages:

LG Energy Solution combines mature R&D with large-scale production and a global supply footprint. For developers and integrators, the advantage is dependable delivery at scale: controlled manufacturing processes, consistent quality, and the ability to support long-life projects with repeatable supply across phases. This is especially useful for multi-site programs and projects that require international sourcing, documentation readiness, and stable long-term performance.

Samsung SDI

Founded: 1970

Headquarters: Yongin, South Korea

Products & What They Do:

Samsung SDI provides ESS batteries, modules, and packs that underpin the battery-side performance of commercial energy storage systems. The product focus is steady charge/discharge behavior and dependable operation over long service lifetimes, even as loads, temperatures, and operating strategies vary.

In practice, this supports both behind-the-meter systems—where demand can change quickly—and grid-connected projects that need stable dispatch performance. The overall emphasis is durability, reliability, and long-term consistency.

Applications:

C&I deployments, supply to system integrators/OEMs, and projects where reliability and long lifecycle performance are a priority.

Company Advantages:

Samsung SDI’s long manufacturing track record shows in its quality and reliability discipline. Customers often value the brand for consistent performance across production batches and stable long-term behavior—important for safety-focused projects and predictable O&M planning. For integrators, that consistency can also make commissioning and fleet-level performance tracking more straightforward across multiple sites or repeated deployments.

B.BESS Integrators & Commercial Energy Storage Solution Providers

Tesla Energy

Founded: Energy business launched publicly in 2015 (Tesla, Inc. founded in 2003)

Headquarters: Austin, Texas, USA

Products & What They Do:

Tesla Energy is best known for grid-scale battery systems such as Megapack, built as modular blocks for large projects and selected commercial energy storage deployments. Rather than assembling many separate subsystems on site, the platform integrates the main pieces—battery storage, power conversion, thermal management, safety protection, and controls—into a more installation-ready package.

In everyday operation, these systems are typically used to follow straightforward dispatch goals: charge when energy is abundant or lower-cost, and discharge when demand rises, renewables fluctuate, or site resilience is needed. For many operators, the practical appeal is consistency—one standardized platform that can be deployed across multiple projects with similar control logic and operating routines.

Applications:

Utility-scale storage plants, grid services and stability support, renewable integration, and selected large commercial energy storage deployments.

Company Advantages:

Tesla’s strengths are most visible in repeatability at scale. A standardized system design can reduce integration effort, simplify commissioning, and make multi-project rollout more predictable. For organizations managing multiple sites, that can also mean more consistent system behavior across a fleet, easier performance comparison between projects, and simpler replication of operating settings as new capacity is added over time.

Fluence

Founded: 2018 (launched by AES and Siemens)

Headquarters: Arlington, Virginia, USA

Products & What They Do:

Fluence delivers BESS solutions that combine storage hardware with a strong software and analytics layer. Rather than treating storage as a fixed “charge at X / discharge at Y” asset, Fluence places heavy emphasis on how the system is operated—dispatch control, monitoring, and ongoing optimization—so performance can be managed as conditions change.

In practical terms, this supports projects where value comes from smarter control and continuous refinement: adjusting to evolving market rules, optimizing around different operating goals, and maintaining reliable performance through changing seasons, duty cycles, and grid conditions.

Applications:

Grid-scale BESS, ancillary services, renewable-plus-storage, and selected commercial energy storage system projects in markets that benefit from flexible dispatch and optimization.

Company Advantages:

Fluence is often associated with software-enabled operations. When control tools, monitoring, and system delivery are designed to work together, owners can gain clearer visibility into performance, more structured reporting, and better long-term operational consistency. This is especially useful for portfolios that need repeatable dispatch strategies, performance tracking across sites, and a pathway to stacking multiple value streams where market structures allow.

Huawei Digital Power

Founded: Commonly referenced around 2021 for the Digital Power business

Headquarters: Shenzhen, China

Products & What They Do:

Huawei Digital Power offers PV + storage solutions such as FusionSolar and platforms like Smart String ESS, with a strong focus on digital monitoring, O&M tooling, and system safety. The approach is centered on coordination—aligning PV output, storage charging/discharging, and site consumption so customers can increase self-consumption and reduce peak-time grid purchases.

Day to day, the system value is often felt through visibility and control: remote monitoring, alarms, performance tracking, and structured maintenance workflows that make the solution easier to manage—especially across multiple locations.

Applications:

C&I solar + storage, industrial/commercial site energy management, and selected larger projects depending on region—particularly where digital operations are a priority for commercial energy storage.

Company Advantages:

Huawei’s strengths typically sit in the digital layer. Robust monitoring and remote O&M can reduce operational blind spots, speed up troubleshooting, and support more consistent management across sites. For customers, this often translates into clearer performance transparency, smoother maintenance routines, and tighter PV-storage coordination under a single operating framework.

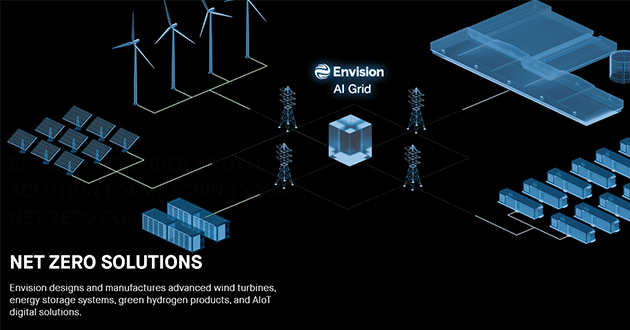

Envision Energy

Founded: 2007

Headquarters: Shanghai, China

Products & What They Do:

Envision provides storage systems alongside digital energy management capabilities, with an emphasis on data-driven optimization and coordination across multiple assets. Instead of treating storage as a standalone unit, Envision often frames it as part of a broader operating system—linking generation, storage, loads, and management software to improve overall site performance.

In practical deployments, this fits projects where coordination matters—such as industrial parks, multi-building campuses, or portfolios that expect to add more assets over time and want a more structured way to manage them.

Applications:

Industrial parks, C&I deployments, and selected utility-scale projects—especially where energy management and operational optimization drive the commercial energy storage business case.

Company Advantages:

Envision is commonly recognized for platform thinking and lifecycle management. For customers, this can mean better visibility across assets, smoother coordination between systems, and easier scaling as sites expand or new resources are added—benefits that tend to matter most in long-term programs rather than one-off installations.

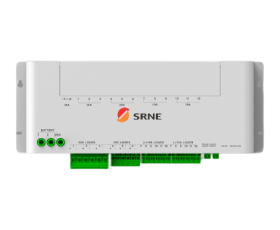

SRNE

Founded: 2009

Headquarters: Shenzhen, China

Products & What They Do:

SRNE’s flagship product for commercial energy storage is its C&I Storage Inverter line—for example, 50–60kW three-phase models with 4 MPPTs. These inverters act as the control and conversion hub that coordinates PV generation, battery charging/discharging, site loads, and grid interaction. In practical terms, they help sites run common strategies such as peak shaving, TOU load shifting, higher PV self-consumption, backup support, demand response, microgrid operation, and power-quality support.

A standout capability is Dual Battery Independent Management. The inverter manages two battery inputs independently, and SRNE states it can mix new and old battery packs. The specifications also list 75A per battery input, and up to 150A when the two inputs are paralleled, with compatibility references to common 100/200/280/314Ah cell configurations. For many projects, this translates into a smoother expansion path—start with a smaller battery bank and scale later without rebuilding the whole system architecture.

Applications:

Factories, campuses/industrial parks, and commercial buildings—especially sites that want bill savings through peak management, stronger continuity through backup capability, and a straightforward way to expand capacity as energy needs grow.

Company Advantages:

Built for phased growth on the battery side: Independent dual-battery design, support for mixed battery groups, and higher current capability via parallel inputs—useful for staged deployments and later upgrades.

Protection features aligned with PV + storage risks: Includes functions such as DC arc-fault detection (AFCI) and surge protection, supporting safer operation in real-world installations.

Practical for microgrids and unstable grids: Supports coordination with diesel generators and is designed to handle challenging conditions such as unbalanced loads and grid instability.

Integration and scale-up readiness: Offers local and remote monitoring (local HMI and cloud visibility), common integration options (e.g., Modbus), and the ability to parallel multiple inverters to increase project capacity.

C. Inverters/PCS & ESS Providers

Sungrow

Founded: 1997

Headquarters: Hefei, Anhui, China

Products & What They Do:

Sungrow offers PCS, inverters, and ESS solutions used in both utility-scale projects and commercial energy storage deployments. In simple terms, this equipment is the “power bridge” of a PV + storage system—converting and managing electricity flow between batteries/PV on the DC side and the site loads or grid on the AC side, while keeping the system running smoothly under different operating conditions.

On-site, that translates into the functions owners actually use: peak shaving to keep demand spikes under control, load shifting to avoid high-priced hours, backup-capable designs where resilience is part of the plan, and power-quality support when a facility needs steadier operation. These roles are especially important in PV + storage projects where control logic and conversion efficiency directly affect savings and performance.

Applications:

C&I and utility-scale PV + storage projects, including a wide range of commercial energy storage installations across different industries and site constraints.

Company Advantages:

Sungrow is often chosen for its depth in power electronics and a broad product range that fits many project types. For EPCs and owners, this can mean simpler system selection, more repeatable engineering and commissioning, and a track record that helps reduce uncertainty when rolling out storage across multiple sites or expanding capacity over time.

Read more:

https://www.srnesolar.com/articledetail/how-much-does-commercial-energy-storage-cost.html

Conclusion

The most effective projects usually come down to alignment: pairing the right technology stack with your load profile, tariff structure, backup requirements, and expansion plan. Use the three-category view above as a shortcut to shortlist partners—then validate the final choice against your specific site conditions, operational priorities, and long-term growth roadmap.